Who is ready for a new stable report? This report is prepared to give insights into the competition within the stablecoin market. To better analyze the market, we categorize stablecoins into three groups and blockchains into four. The groups of stablecoins are named “leagues,” and the chains are named “tiers.” Let’s begin this week’s report. In this report, you will find:

Total review of the stablecoin market and a breakdown by projects.

Total breakdown of the stablecoin market by blockchains.

The most attractive stablecoin yields.

Important events and news from the last week.

unStable Summit – A Must-Attend Event for Stablecoin Enthusiasts

Useful resources for more stablecoin information.

Total Review of Stablecoin Market and Breakdown by Projects

As of October 27th, the total stablecoin market stands at $171.89 billion, marking a decrease of 0.12% compared to October 20th. USDT's dominance has slightly increased, now at 69.96%, up from 69.81% last week.

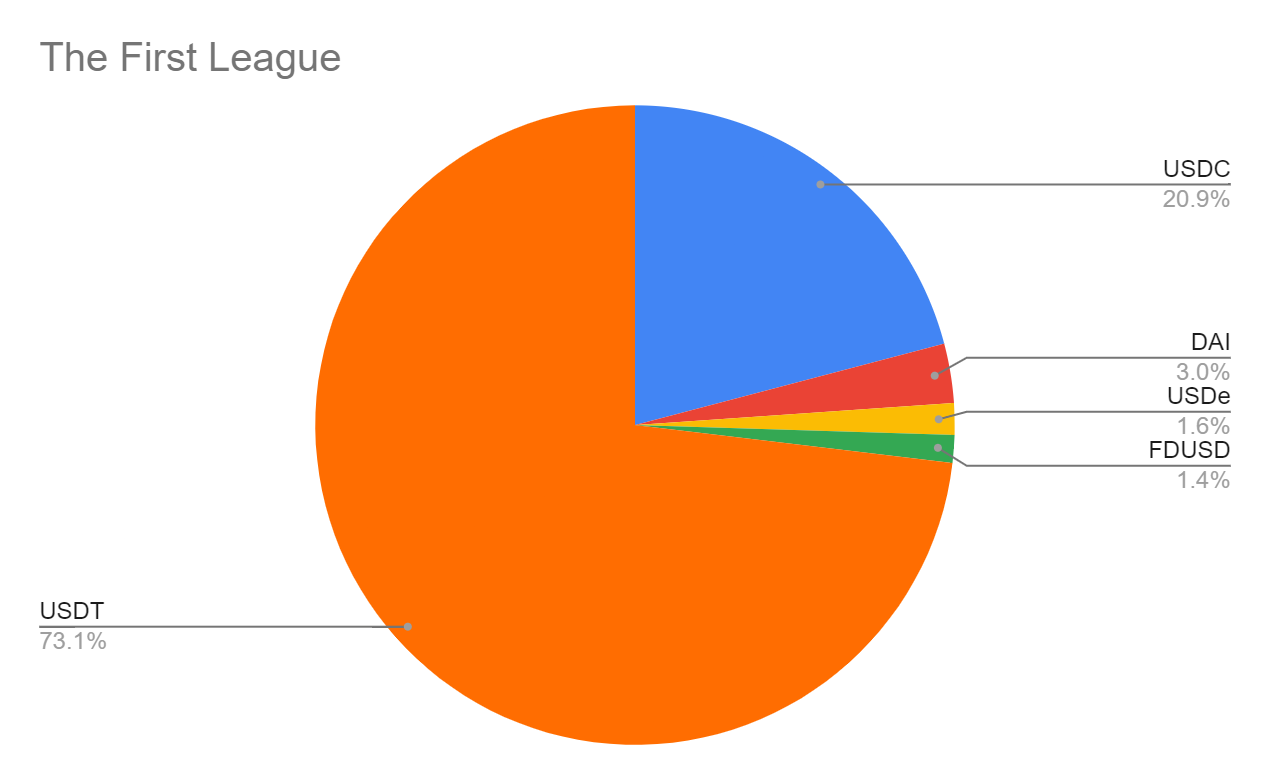

The First League

The total market cap of stablecoins with a market cap over $1 billion, i.e., the stables of the first league, is $164.36 billion, down by 0.22% compared to the previous week. The pie chart below illustrates the market cap distribution of the stablecoins in this league.

In the previous week, there were 6 stablecoins competing in the first league. However, last week Sky burned about $160M worth of USDS, and the market cap of USDS became less than $1 billion, dropping it to the second league. The table below shows the new rank list of the first league.

Last week, only USDe and USDT were in the green, with USDe growing 4.34% and USDT growing 0.11%. On the negative side, we observed FDUSD decrease by 5.33%, followed by DAI’s 3.43% shrinkage. The table below shows the 7-day change in market cap of the stablecoins in the first league.

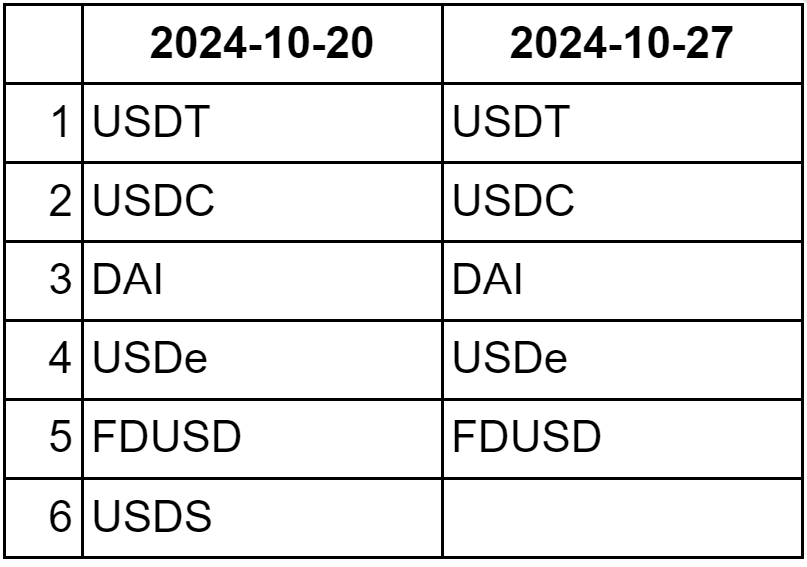

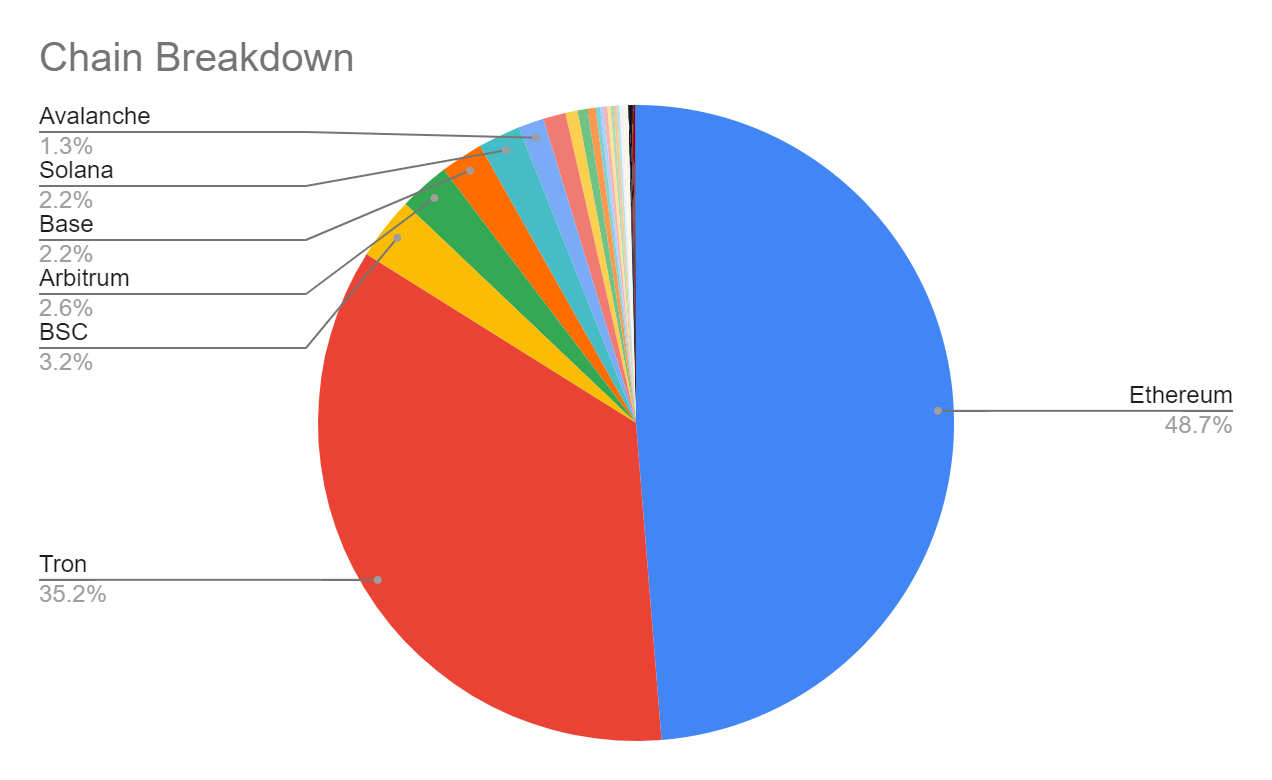

The Second League

Now, let’s take a look at the second league, which includes stablecoins with a market cap between $100 million and $1 billion. The total market cap of the stablecoins in this league decreased by 2.53% last week, making it $5.427 billion. In the previous week, there were 13 stablecoins in this league; now there are 14, including USDS. The pie chart below illustrates the market cap distribution of the stablecoins in this league.

Last week, almost all of the ranks changed in the second league due to USDS joining. Only DOLA protected its position because it flipped USDB. The table below shows the new ranks of the stablecoins in the second league.

USDS was the biggest loser in this league, with a 14.40% decrease in market cap. USDB and BUIDL followed with decreases of 5.04% and 3.86%, respectively. On the positive side, we saw USD0 with an 8.40% increase. GHO, DEUSD, and DOLA also showed notable performances with increases ranging between 4.50% and 4.92%. The table below shows the 7-day change in market cap of the stablecoins in the second league.

The Third League

The third league contains stablecoins with a market cap between $30 million and $100 million. The total market cap of this league increased by 9.79%, reaching $858.77 million. In the previous week, there were 17 stablecoins in this league. After CUSD’s $5.3M burn event, its market cap dropped below the $30M threshold, pushing it out of the league. The pie chart below illustrates the market cap distribution of the stablecoins in the third league.

In addition to CUSD’s exit, we observed a couple of position changes in the third league. M^0’s M flipped 6 stablecoins ahead of it and became the third biggest one in the league. Meanwhile, USDM flipped MIM and protected its position. Additionally, SUSD flipped BEAN, making BEAN the smallest stablecoin in this league. The table below shows the new ranks of the third league.

M was the biggest gainer of the third league with a 36.07% increase. On the negative side, MIM and USD+ drew attention with 4.96% and 2.94% decreases, respectively. The market cap change for the remaining stablecoins in this league was quite limited, bounded by 1.59%. The table below shows the 7-day change in market cap of the stablecoins in the third league.

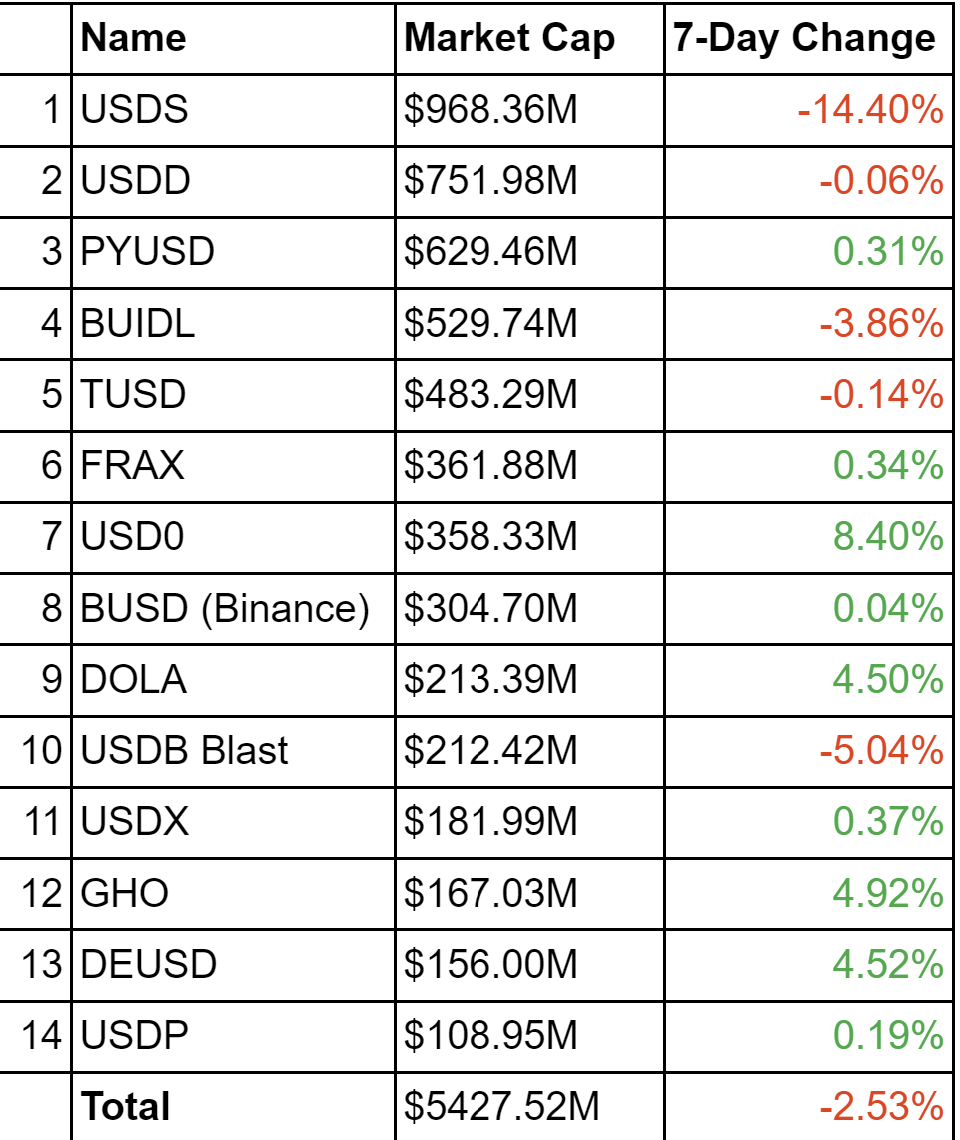

Total Breakdown of Stablecoin Market by Blockchains

Now, let’s examine the competition among chains to attract more stablecoins. Since Ethereum and Tron have significant dominance compared to other chains, we will analyze them separately. The pie chart below shows how Ethereum and Tron compare to other chains in holding stablecoins.

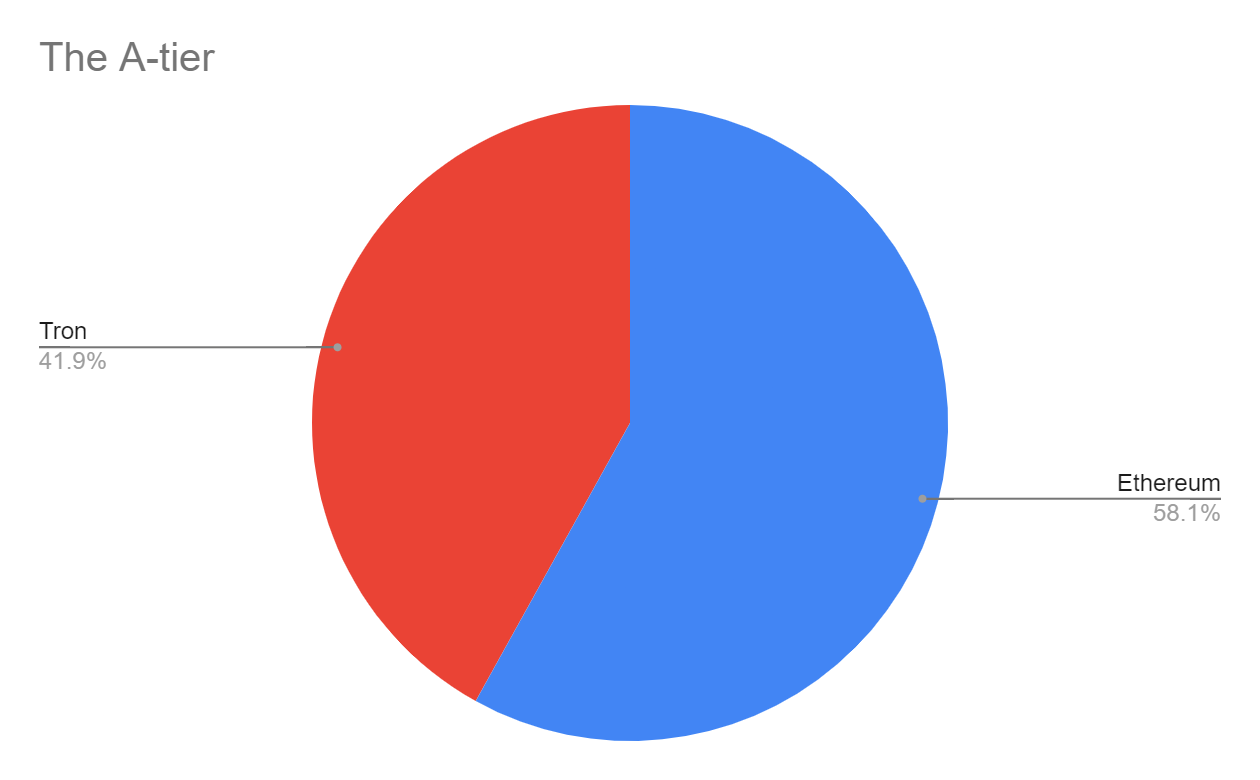

Let’s start with the A-tier, i.e., Ethereum and Tron.

The A-tier

Total stablecoin issuance on the A-tier chains decreased by 0.27% last week, reaching $144.37 billion. Tron gained 0.2% dominance compared to the previous week. The pie chart below shows their dominance.

Tron saw slightly positive issuance last week. Total stablecoin issuance on Tron increased by 0.40%, reaching $60.54 billion. On the other hand, total stablecoin issuance on Ethereum decreased by 0.74%, making it $83.82 billion. The table below shows the 7-day change in market cap of the stablecoins on blockchains in the A-tier.

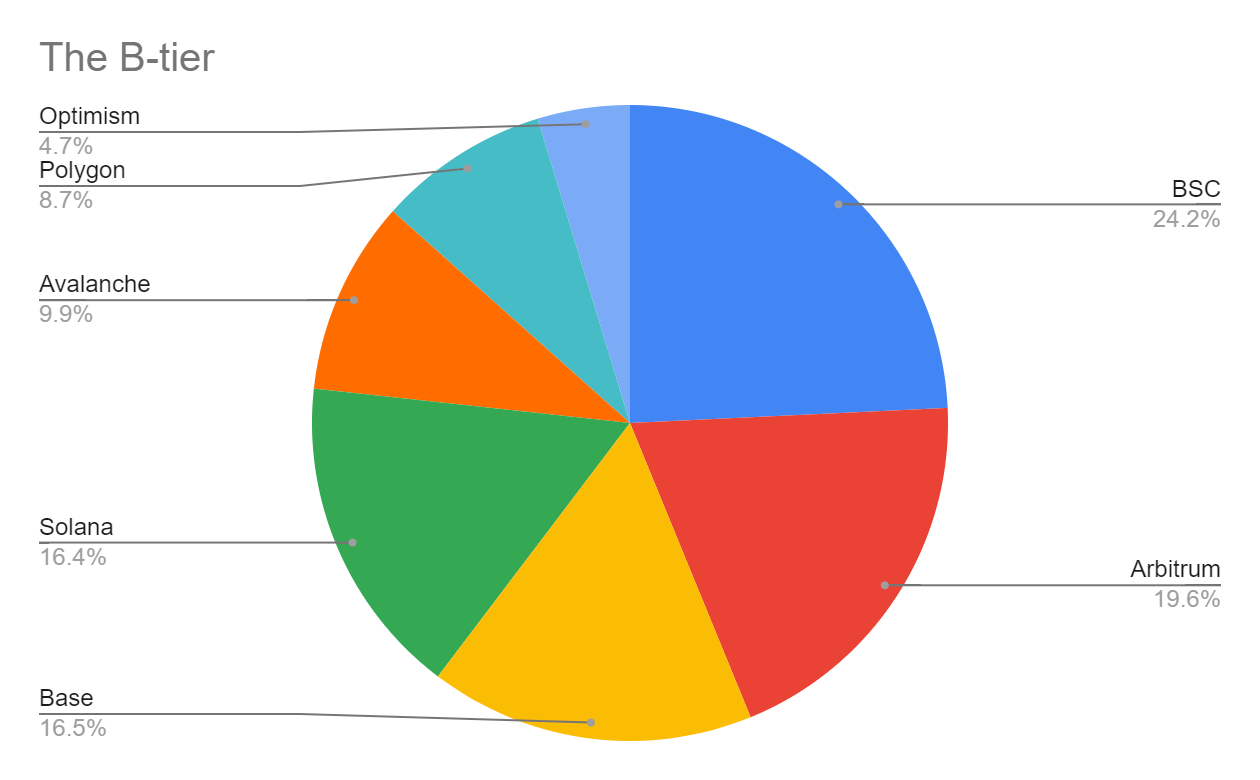

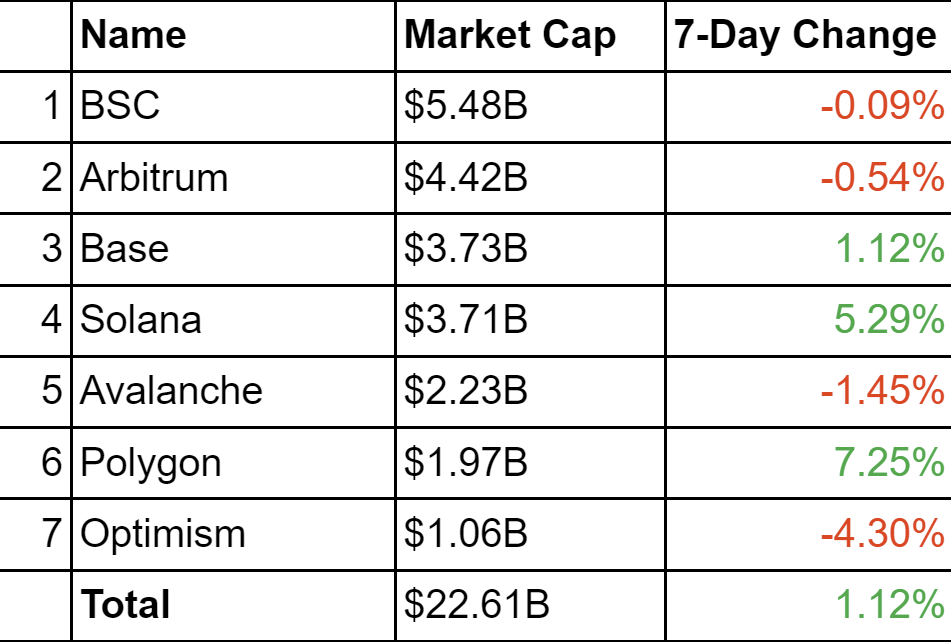

The B-tier

The B-tier includes blockchains with a stablecoin market cap between $1 billion and $10 billion. This tier holds $22.61 billion in stablecoins, with a 1.12% decrease compared to the previous week. As in previous weeks, seven chains are competing in this tier, with Binance Smart Chain leading the competition. The pie chart below illustrates the market cap distribution of the B-tier chains.

The blockchains in the B-tier maintained their ranks last week.

In the B-tier, Polygon and Solana showed significant growth in terms of stablecoins last week, corresponding to 7.25% and 5.29% increases, respectively. Base was also positive last week. On the negative side, Optimism lost 4.30% of its stablecoins, while Avalanche lost 1.45%. The table below shows the 7-day change in market cap of the stablecoins on blockchains in the B-tier.

The C-tier

The C-tier contains blockchains with a stablecoin market cap between $30 million and $100 million. The C-tier experienced a 0.76% decrease in total stablecoin issuance last week. As of October 27th, the total issuance in the C-tier is $4.32 billion. In the previous week, there were 15 chains competing in this tier, but as of October 26, Scroll’s stablecoin issuance became less than $100 million, making Scroll a D-tier chain. The pie chart below illustrates the market cap of the stablecoins on blockchains in the C-tier.

In addition to Scroll’s drop, we witnessed two flippenings. Fantom flipped Sui and became the 4th largest chain in this league. Additionally, Aptos flipped Noble and secured the 7th position. The table below shows the new ranks in the C-tier.

Gnosis was the biggest stablecoin gainer in the C-tier with a 7.03% increase. Stellar and Aptos also showed notable performances last week. On the red side, the biggest stablecoin loser was Sui with a 9.29% decrease. Sui was followed by Blast and Mantle with decreases of 5.36% and 4.15%, respectively. The table below shows the 7-day change in market cap of the stablecoins on blockchains in the C-tier.

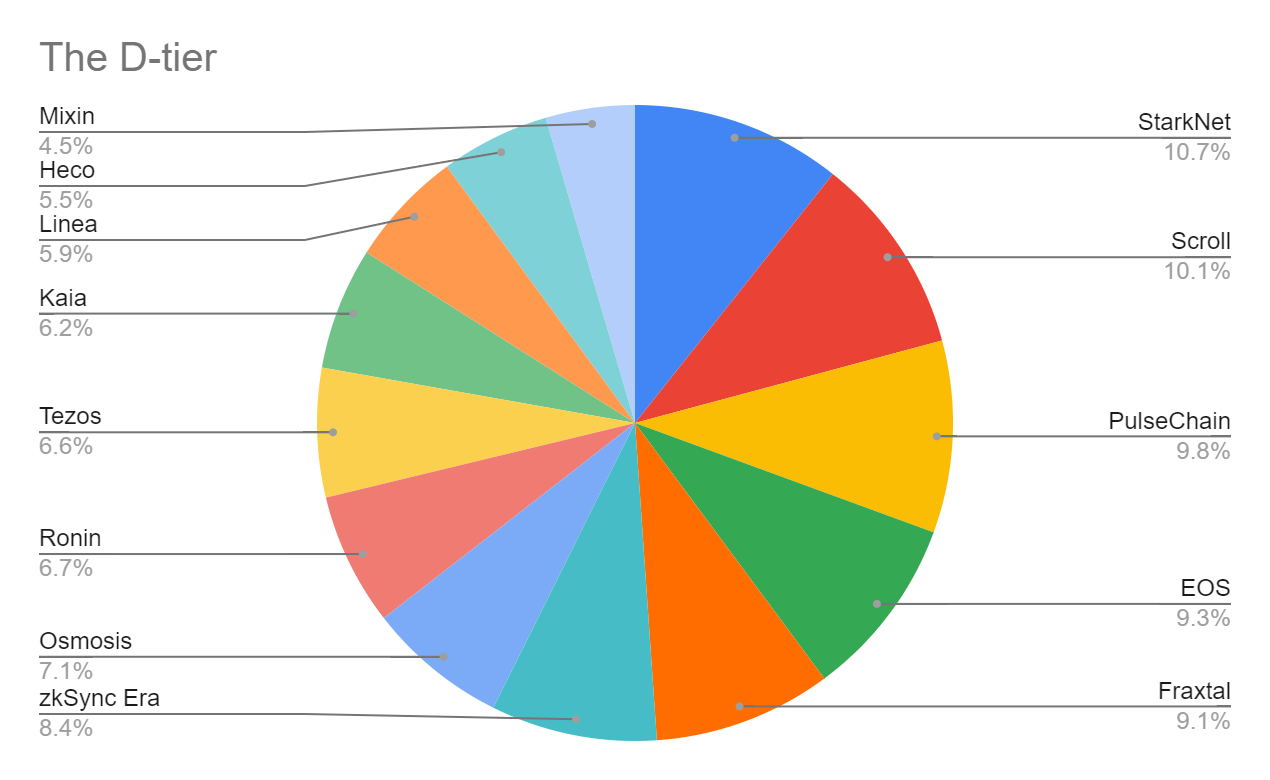

The D-tier

Let’s investigate the D-tier now, which includes blockchains with stablecoin issuance between $30 million and $100 million. Total stablecoin issuance on the chains in this tier decreased by 6.18% last week, dropping to $789.39M. This tier includes 13 chains, with their dominance ranging between 10.7% and 4.6%. Recall that last week the D-tier had 14 chains. In addition to Scroll joining this tier, Metis and Injective left since they no longer have more than $30 million in stablecoins. The pie chart below shows the competition among chains in the D-tier.

Scroll’s participation changed 12 out of 13 positions in this tier. Every chain dropped a position except StarkNet. Since Injective and Metis held the last two positions in the tier, their drop didn’t affect the position of other stablecoins. The table below shows the new ranks in the D-tier.

The D-tier was mostly red last week, with only 4 out of 13 chains closing the week positively. Fraxtal was the biggest gainer with a 3.66% increase, while the gains of Linea, PulseChain, and Ronin were negligible. On the negative side, the biggest loser was Scroll with a 38.05% decrease. The remaining negative chains’ decreases were limited to 3.13%. The table below shows the 7-day change in market cap of the stablecoins on blockchains in the D-tier.

The Most Attractive Stablecoin Yields

Let's take a look at the stablecoins offering the highest APYs. These yields are sourced from DeFiLlama and include all types of yields with over $10 million in TVL. Remember that interactions with contracts carry various risks, including hacks, exploits, impermanent loss, depegging scenarios, etc. Please be aware of these risks before engaging and always DYOR!

Important Events and News from Last Week

MakerDAO Rebrand to Sky Faces Community Backlash

Sky, formerly MakerDAO, is reconsidering its recent rebrand due to confusion within the community. Co-founder Rune Christensen has proposed governance votes to decide whether to keep the Sky brand, merge the two brands with distinct roles, or refresh MakerDAO’s identity. This comes after mixed feedback following the rebranding of key elements to Sky in August.

Critics Say Federal Reserve Shouldn’t Regulate Stablecoins

Policy experts argue that the Federal Reserve is ill-suited to oversee stablecoins, citing conflicts of interest with its own payment systems and potential central bank digital currency (CBDC) plans. They recommend focusing on transparency and collateral requirements instead of a bank-like regulatory approach, which could stifle private stablecoin innovation.

Tether CEO Predicts U.S. Will Soon Catch Up with Crypto Regulations

Speaking at DC Fintech Week, Tether CEO Paolo Ardoino expressed optimism that the U.S. will soon implement sensible crypto regulations. Highlighting Tether’s cooperation with global regulators and law enforcement, Ardoino emphasized that stablecoins could offer crucial financial lifelines in regions lacking access to traditional banking.

Stripe Confirms $1.1 Billion Acquisition of Stablecoin Platform Bridge

Stripe has finalized a $1.1 billion acquisition of the stablecoin-focused fintech Bridge. The deal aims to integrate Bridge’s stablecoin infrastructure into Stripe’s payments ecosystem, allowing developers to build on a blockchain-based global payments system. This acquisition strengthens Stripe’s push into crypto and stablecoin services.

Tether CEO Raises Concerns Over MiCA’s Systemic Banking Risks for Stablecoins

Tether’s CEO, Paolo Ardoino, expressed concerns that Europe’s MiCA framework could create systemic risks for stablecoin issuers by requiring 60% of reserves to be held in European banks. Ardoino warned that these reserve requirements could make stablecoins vulnerable to bank failures and impact stability in the crypto space.

Bolivian Bank Launches USDT Custody Service as Crypto Adoption Rises

Bolivia’s Banco Bisa has introduced a custody service for USDT stablecoin, allowing clients to buy, sell, and transfer crypto within a regulated framework. The move comes as Bolivia shifts its stance on cryptocurrencies and aims to align with regional regulations while promoting safer crypto transactions.

Coinbase’s Base Network Briefly Leads in Daily Stablecoin Volume

Coinbase’s Base network set a record on Oct. 26, briefly leading all blockchains in daily stablecoin volume, surpassing Solana, Ethereum, and Tron. The network accounted for 30% of stablecoin volume on that day, driven by increased activity and a surge in USDC transactions. Base continues to gain ground against its competitors.

Tether CEO Defends USDT’s Reserves Amid Investigation Rumors

During a conference in Lugano, Tether CEO Paolo Ardoino detailed the assets backing USDT, including $100 billion in US Treasuries, 82,000 Bitcoin, and 48 tons of gold. He dismissed claims of a DOJ investigation as recycled misinformation, emphasizing Tether’s cooperation with law enforcement to prevent illicit activities.

Wintermute Accepts Ethena’s USDe Stablecoin for Margin Trading

Trading firm Wintermute is now accepting Ethena Labs’ USDe stablecoin as collateral for crypto and derivatives trading. This move reflects the growing trend of using cryptocurrency-backed assets as collateral, positioning USDe alongside Bitcoin, Ether, and USDC in Wintermute’s collateral roster.

Fireblocks Launches $1M Grant to Boost PYUSD Developer Adoption

Fireblocks announced a $1 million grant program to incentivize developers using PayPal’s PYUSD stablecoin. Eligible projects can receive up to $60,000 each to create blockchain-based payment solutions, leveraging Fireblocks’ secure multiparty computation technology.

Centrifuge Partners with Fireblocks to Expand Tokenized RWA Offerings

Centrifuge has integrated with Fireblocks to provide secure custody for real-world assets (RWAs) on its platform. This partnership makes Centrifuge accessible to over 2,000 institutions using Fireblocks, enhancing its on-chain credit and financing capabilities. Centrifuge aims to meet growing demand for tokenized assets with increased security and scalability.

Tether Explores Boron-Backed Tokens in Talks with Turkey

Tether is exploring the creation of blockchain tokens backed by borate minerals with Turkey, which holds 70% of the world’s boron reserves. The proposal aligns with Turkey’s growing interest in digital asset innovations, as Tether aims to contribute to the country’s blockchain ecosystem.

Crypto Bills May Progress in Final Congressional Session, Says Rep. Hill

Rep. French Hill expressed optimism that two key crypto bills—one on stablecoins and another on regulatory frameworks—might advance in the U.S. Congress’ “lame duck” session. Progress hinges on aligning priorities within the outgoing Congress and the finalizing of the defense spending bill.

Tether Faces U.S. Probe Over Possible Sanction Violations

According to the Wall Street Journal, U.S. prosecutors are investigating Tether over potential violations of anti-money laundering laws and U.S. sanctions. Tether’s CEO denied the claims, calling them baseless and highlighting the firm’s history of working closely with law enforcement agencies.

JPMorgan: Tokenized Treasuries Won’t Fully Replace Stablecoins

JPMorgan analysts believe tokenized U.S. Treasuries could challenge stablecoins as yield-bearing assets, but regulatory restrictions and liquidity constraints make them unlikely to fully replace stablecoins. The growing market for tokenized Treasuries signals new competition for stablecoins in collateral use cases.

Skyfire Secures Additional Funding from Coinbase Ventures and a16z

Skyfire, a firm developing AI-driven autonomous payment systems, has increased its total funding to $9.5 million with new backing from Coinbase Ventures and a16z. Skyfire’s infrastructure supports AI agents making instant payments using USDC, positioning it as a key player in the emerging AI economy.

Justin Sun’s Involvement Could Benefit Wrapped Bitcoin Project, New Custodian Says

BiT Global, a new custodian for Wrapped Bitcoin (WBTC), defended Tron founder Justin Sun’s role as an advisor, citing his past successes in the industry. BiT Global aims to grow WBTC as a decentralized alternative to bitcoin ETFs, focusing on building trust through transparency and secure multi-jurisdictional custody arrangements.

Circle’s EURC Stablecoin Hits New Supply Record on Layer 2 Base

The euro-backed stablecoin EURC has reached an all-time high supply of 91.8 million, driven by growth on the Base network. As the largest euro stablecoin by market cap, EURC has gained traction since Circle received its MiCA compliance license in the EU. Despite its growth, EURC’s market cap remains a small fraction of the dominant U.S. dollar-pegged stablecoins.

Tether CEO Emphasizes Transparency Amid Regulatory Scrutiny

At DC Fintech Week, Tether CEO Paolo Ardoino stressed the importance of transparency and compliance for the stablecoin issuer. Amid scrutiny and new regulations under MiCA, Ardoino reiterated Tether’s commitment to holding a substantial amount of U.S. Treasuries and working with global regulators to ensure compliance.

Stablecoins Cement Status as Crypto’s Dominant ‘Killer Use Case’

Stablecoins have solidified their position as crypto’s most dominant application, with $5.1 trillion in transactions in the first half of 2024 alone. Major corporations like Stripe, PayPal, and Ripple are integrating stablecoins, which now rank among the top holders of U.S. Treasuries. Analysts suggest that profit-sharing models could enable stablecoins to rival money market funds in the future.

Lido Launches Permissionless Ethereum Staking with Lower Collateral

Lido DAO has approved a Community Staking Module (CSM) enabling permissionless Ethereum staking with just 2.4 ETH collateral, significantly lowering the typical 32 ETH requirement. Early adopters can stake with as little as 1.5 ETH and receive enhanced rewards. This move aims to democratize Ethereum staking, enhancing network security and decentralization.

[Sponsored] unStable Summit – A Must-Attend Event for Stablecoin Enthusiasts

As the stablecoin space continues to grow and evolve, unStable Summit has become one of the most important gatherings for stablecoin experts, innovators and enthusiasts. This event brings together leading minds in the field to discuss the latest trends, challenges and breakthroughs, making it a must-attend for anyone serious about the future of stablecoin world.

The next unStable Summit is just around the corner, taking place on November 10th in Bangkok, just before Devcon. Whether you're deep into the technical aspects of stablecoin development or just passionate about its potential impact on the global economy, unStable Summit offers a platform for deep learning and meaningful networking.

Here’s what you can look forward to at the upcoming event:

- Technical discussions on stablecoin design, new DeFi opportunities they create and emerging use cases.

- Expert panels featuring some of the most prominent voices in the industry, offering insights into the future of stablecoins and decentralized finance.

- Networking opportunities with developers, investors and thought leaders who are shaping the future of stablecoins.

Don't miss out on the chance to join in on the great discussions and valuable insights that unStable Summit always offers. It’s a perfect opportunity to share ideas, discover new projects and keep up with the world of stablecoins.

For more details and to register for the Bangkok event, visit

Useful Resources for More Stablecoin Information

Last Words

This is the end of the report. Here, I’d like to thank unStable Summit again for supporting this work. I'm sure that this sponsorship will significantly improve the quality of my reports. If you are interested in attending the unStable Summit event, don’t forget to say hi to me.

If you like this report and don’t want to miss new reports and more, I highly recommend subscribing to my Substack!